Finding your next home is just a click away.

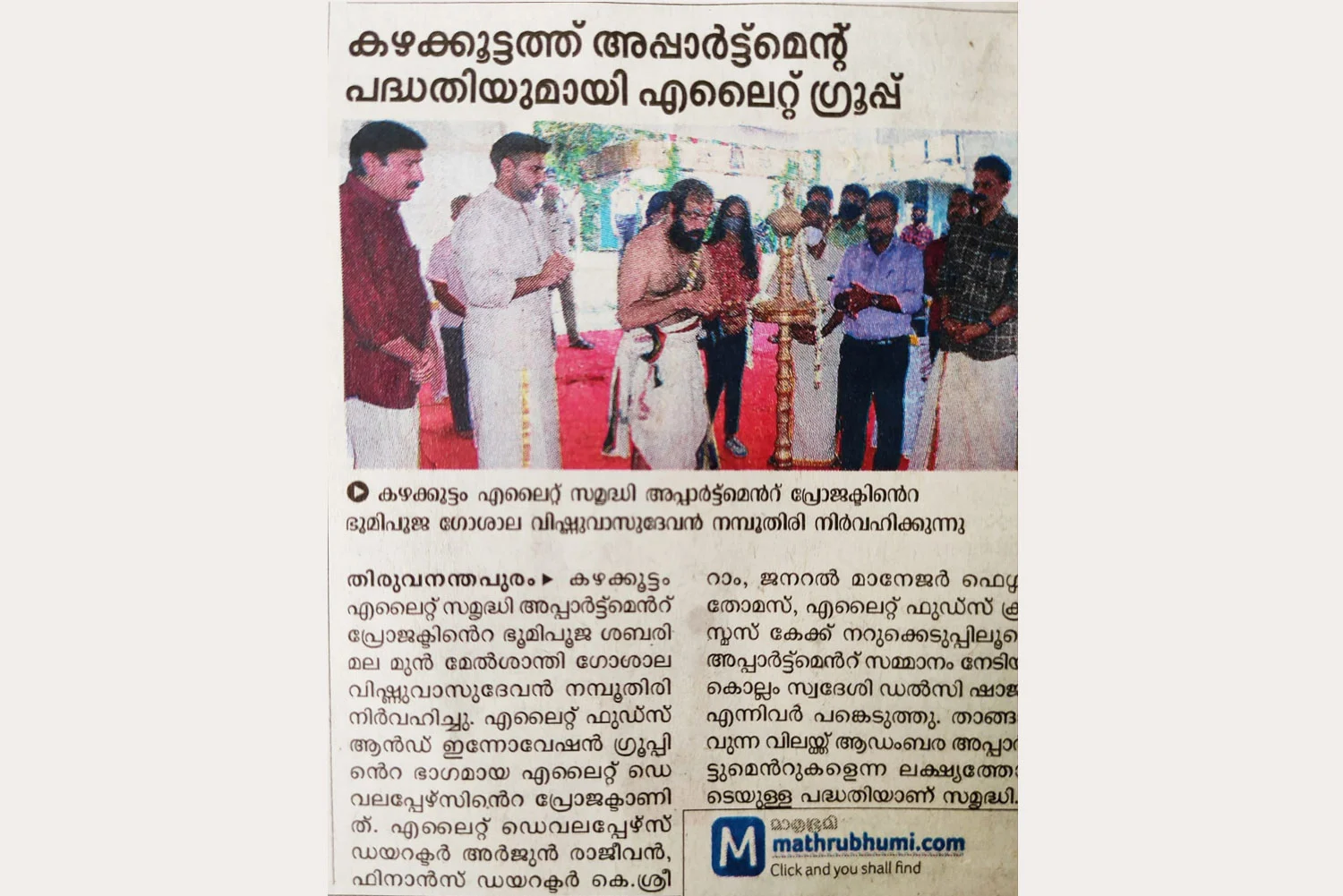

Elite Developers is run by professionals with a passion for quality and offers you spacious

luxury apartments and villa homes developed with an eye for great design employing the best

resources. Check out the uber-luxurious projects such as Elite Insignia apartments...

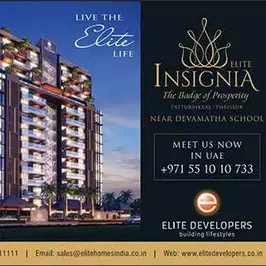

We build apartments for residential and commercial aspects. Elite Insignia is one of our

best residential project in the heart of Thrissur. It can be easily connected with the

important locations in Thrissur city.

FLEXI PAYMENT PLANS

FLEXI PAYMENT PLANS